Features that makes app different!

MTDVAT.com is an innovative user-friendly mobile centeric application solution that facilitates the MTD VAT Agent Authorisation and e-filing of MTD VAT returns. With MTDVAT.com, businesses can seamlessly comply with the Making Tax Digital initiative by securely submitting their VAT returns. This streamlined process ensures accuracy, convenience, and adherence to HMRC's digital tax filing requirements.

E-Filing MTD VAT Return

E-file VAT data single or in batches with maximum accuracy and MTD VAT digital compliance assured, saving time without the need for manual data entry or template copying.

Retrieval of payment, liabilities & penalties

Stay on top of your payment deadlines and reporting obligations to avoid fines and penalties. Get the knowledge you need to pay on time and minimize any interest or late charges.

MTD VAT Agent Authorisation

Our enhanced agent services offer a streamlined solution for tax agents, enabling efficient management of client authorizations, seamless authorization granting.

About Us

Around twelve years experience focusing on eData interchange software development and support, based on open standard and platform independent technology, MTDVAT.com has fast become a specialist eReturn system for HMRC. The skills and commitment we have gained have helped all our clients to achieve a 99.99% success rate in whatever eReturns they have made to HMRC. Our truly open standard and open platform system has seamlessly integrated with many of our clients systems, including Payroll, Accounting, Pension and CIS systems. Without doubt your system will work with our system regardless of the version and the platform you use.

We are proud of what we have achieved in creating a user friendly and cost effective system which saves many software vendors and end user corporates from complicated development work and expensive upgrades. We are continuing to enhance and expand the range of services we offer.

Security: We are ISO 27001 and ISO 9001 certified. We treat our clients' data with the utmost of care and take security issues seriously.

How does MTDVAT.com work?

-

Installing MTD VAT App

To start using the MTD VAT mobile app you should first download and install it on your device. Our MTD VAT app is easily available on the Play store/Apple app store.

01

-

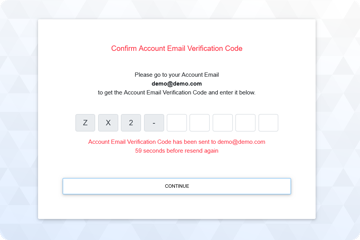

Sign up / Device Activation

Click on SIGN UP button at MTDVAT.com to create an account in the same way you create an internet account. Check your e-mail for an account activation mail with a link from us and activate your account.

02

-

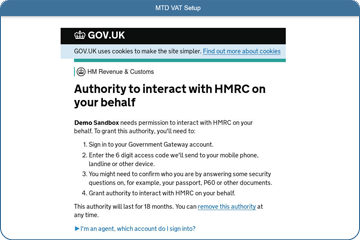

HMRC MTD VAT authorisation

You need to activate the HMRC MTD VAT account at our system to complete the grant authorisation process. You should make use of HMRC gateway ID and password received from HMRC.

03

-

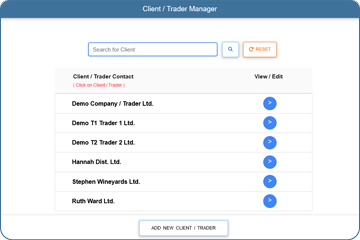

Create Client/Trader manually or in batch

Once the account is successfully created, you can create your Client/Trader details individually by entering the data manually or in batch by uploading your client’s data in CSV format.

04

-

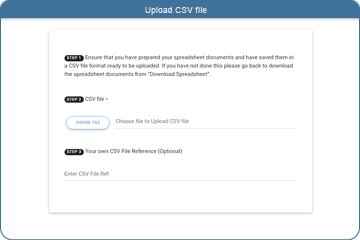

Upload Client/Trader MTD VAT Data

When you upload your Client/Trader MTD VAT Data in a CSV format to our system, please ensure that the CSV file VAT data is consolidated in accordance with HMRC MTD VAT Bridging software guidelines.

05

-

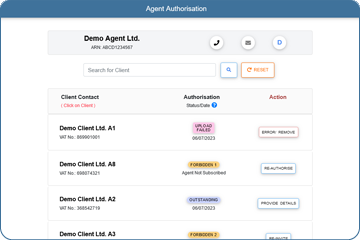

MTD Agent Client Authorisation

If you’re an agent signing up a client you can use this functionality to request authorisation to act on a client's behalf for a specific Making Tax Digital (MTD) tax service. It allows the agent to check the status of authorisations already requested and query active or inactive relationships.

06

-

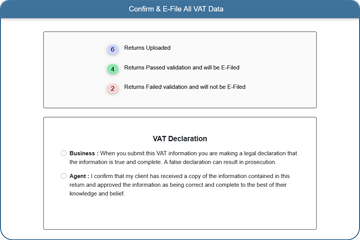

E-filing MTD VAT to HMRC

Access your account from anywhere and e file the uploaded files in a click of a button. In case of CSV imports from Sage, Iris and other packages which contains VAT only data (Box 1 to 9), assigning the Trader Name, VRN and Vat Period will be needed before e-filing the data to HMRC.

07

-

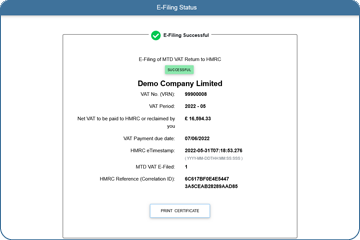

View/ Print the E-file status report

You can view and print the e-filed status report and the E-filing Certificate which will contain the MTD VAT Return Success Response from the HMRC. The system provides other comprehensive reports and searches function for viewing all the MTD VAT you ever made through our system. The MTD VAT data will be kept up to 3 years for viewing at anytime 24 x 7.

08

-

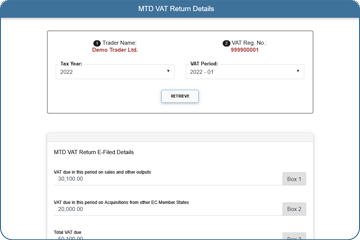

View MTD VAT Returns

You can retrieve MTD VAT return details report from HMRC. The VAT returns details reports provides information about the amount you have paid to HMRC in the form of tax or reimbursement money from HMRC.

09

-

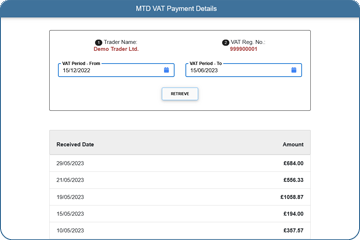

View MTD VAT Payments

Now retrieve the VAT payment report which will contain all the VAT related payment information you have made to HMRC.

10

-

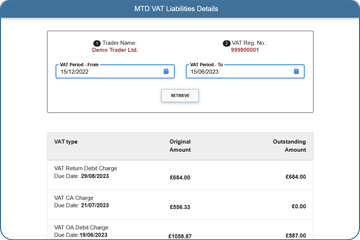

View MTD VAT Liabilities

The VAT liabilities will display the money you owe to HMRC. This report will show the original and outstanding amount for each VAT type.

11

-

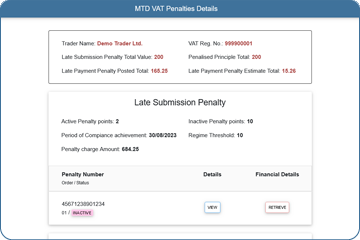

View MTD VAT Penalties

The VAT penalties allows the retrieval of all penalty details that have been applied to a VAT account. Twenty-four months' worth of penalty information will be returned.

12

Pricing

FREE

Viewing and Tracking of MTD VAT Over Mobile App or Desktop

(Best over WWW.MTDVAT.COM mobile App)

Free MTD VAT eReturn *

Monthly or Quarterly

• If your annual total Sales is less than £48,000

Paid MTD VAT eReturn

Monthly or Quarterly

• If your annual total Sales is more than £48,000

Contact Us

Fill up form below, our team will get back soon

Have any question?

-

Email Us sales@mtdvat.com

Email Us sales@mtdvat.com -

Call Us +44 20 3191 6651

Call Us +44 20 3191 6651 -

Visit Us

Visit UsUnit 101, China House 401 Edgware Road London, NW2 6GY United Kingdom